The Derivatives Magazine #15

The crypto market continues to react and reassess the impact of government actions on blockchain applications. OFAC's seemingly insignificant decision to designate the Tornado Cash protocol and a number of related addresses as sanctioned led to the arrest of one developer and a global reassessment of the DeFi segment's prospects.

The market declined slightly during the week, but the decline accelerated at the start of the last trading day in traditional markets. After losing around 12% of total capitalisation over the week, the indicator stabilised at around $1 trillion.

The sharp decline in the price of the major crypto market majors BTC and ETH led to significant liquidations among traders. The total amount of positions closed on Friday and over the weekend was around $600 million. In our latest infographics, we noted that BTC and ETH accounted for the largest amount (more than $200 million per asset in one average trading day). At the moment, the crypto market is under pressure from macro factors on one side and has a strong growth driver in the form of ETH consensus shift in September on the other. Not only the native token, but also the decentralised finance ecosystem has felt the interest and liquidity flow into the ETH ecosystem. Increased legal and systemic risks could undermine investors' optimism and lead to volatile price movements.

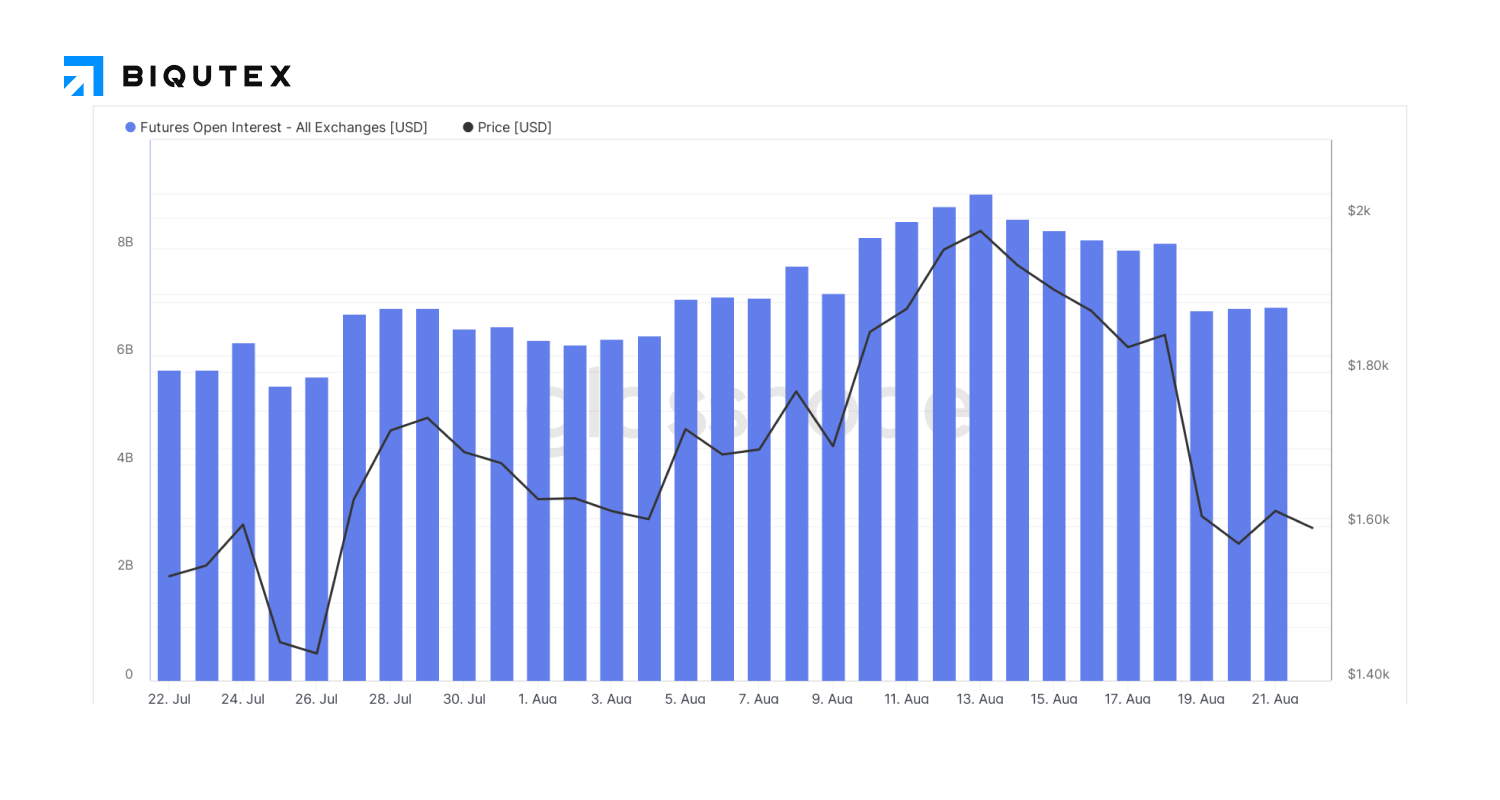

The spot price fluctuations were reflected in the funding rate and the volume of open interest across the entire futures product range. The large amount of ETH futures sold led to a skew in the funding rate, which rose relative to last week on all trading floors and averaged -10% for the most liquid futures instruments (September contracts on FTX, OKEX, Binance).

The BTC trading situation in the last few months has followed the same path as ETH and has not seen much interest from traders. The funding rate is in the 0-5% range, reflecting a pattern of passive consolidation in the market. In the absence of independent information drivers, BTC remains highly correlated to the traditional financial market, where a decline in quotations would cause crypto assets to fall in price as well.

The level of open interest in ETH futures trading has declined from the local highs to $6.5 billion. Despite a significant drop in the spot price, derivatives trading activity continues to remain strong, confirming liquidity ahead of the consensus shift.

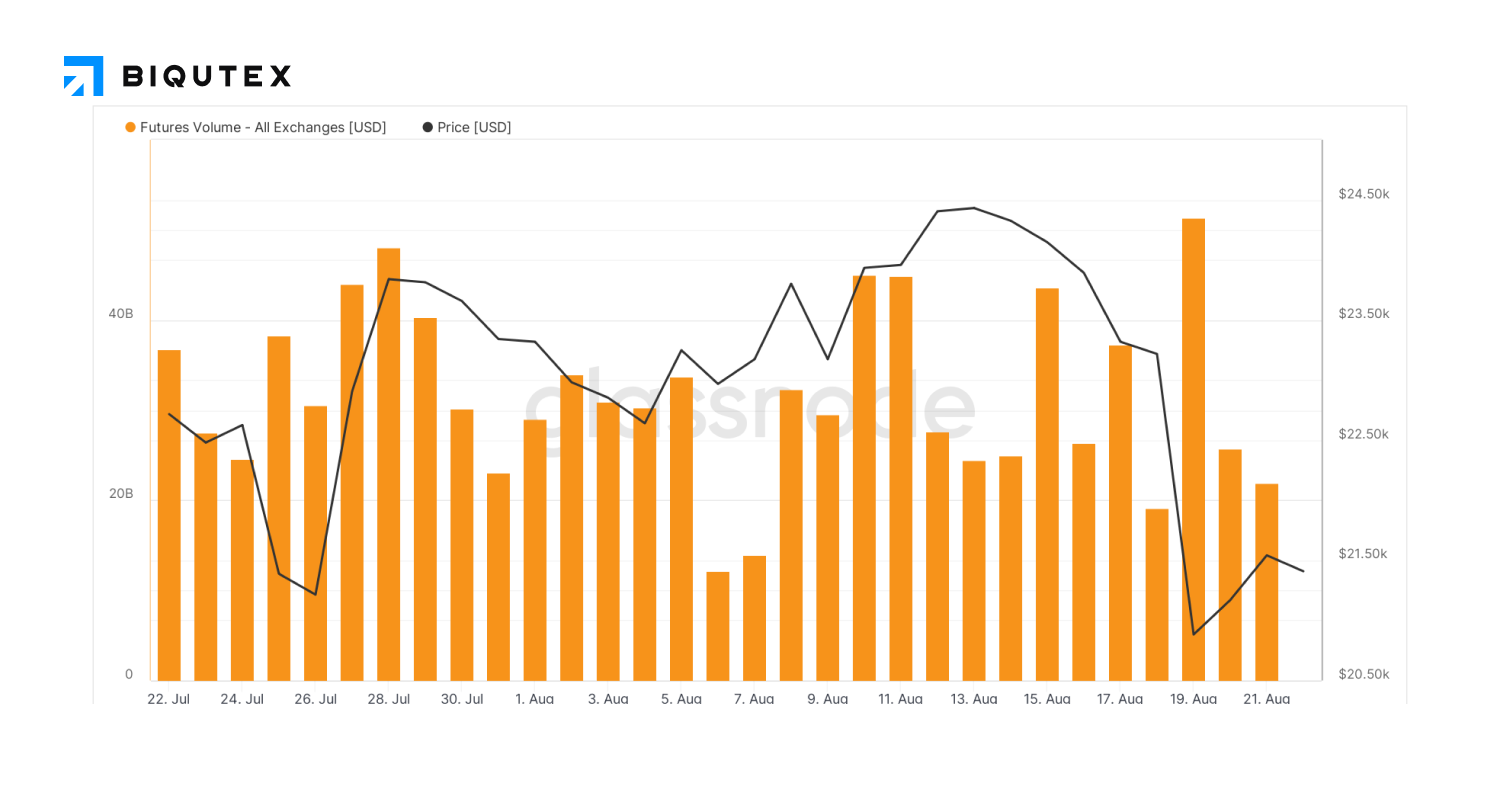

In contrast, bitcoin futures trading volume fell following the drop in the spot price and returned to monthly lows of around USD 20 billion per day.

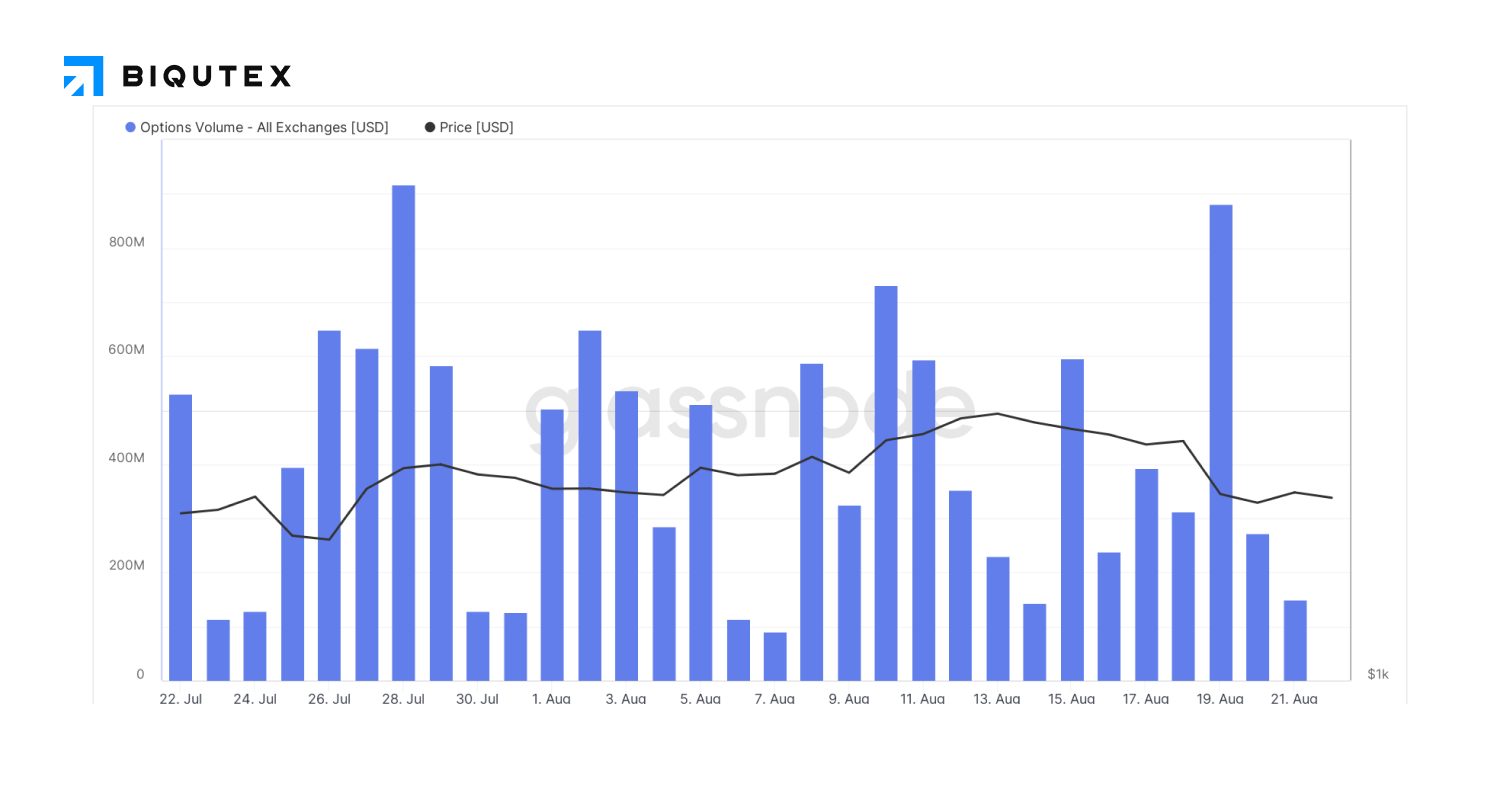

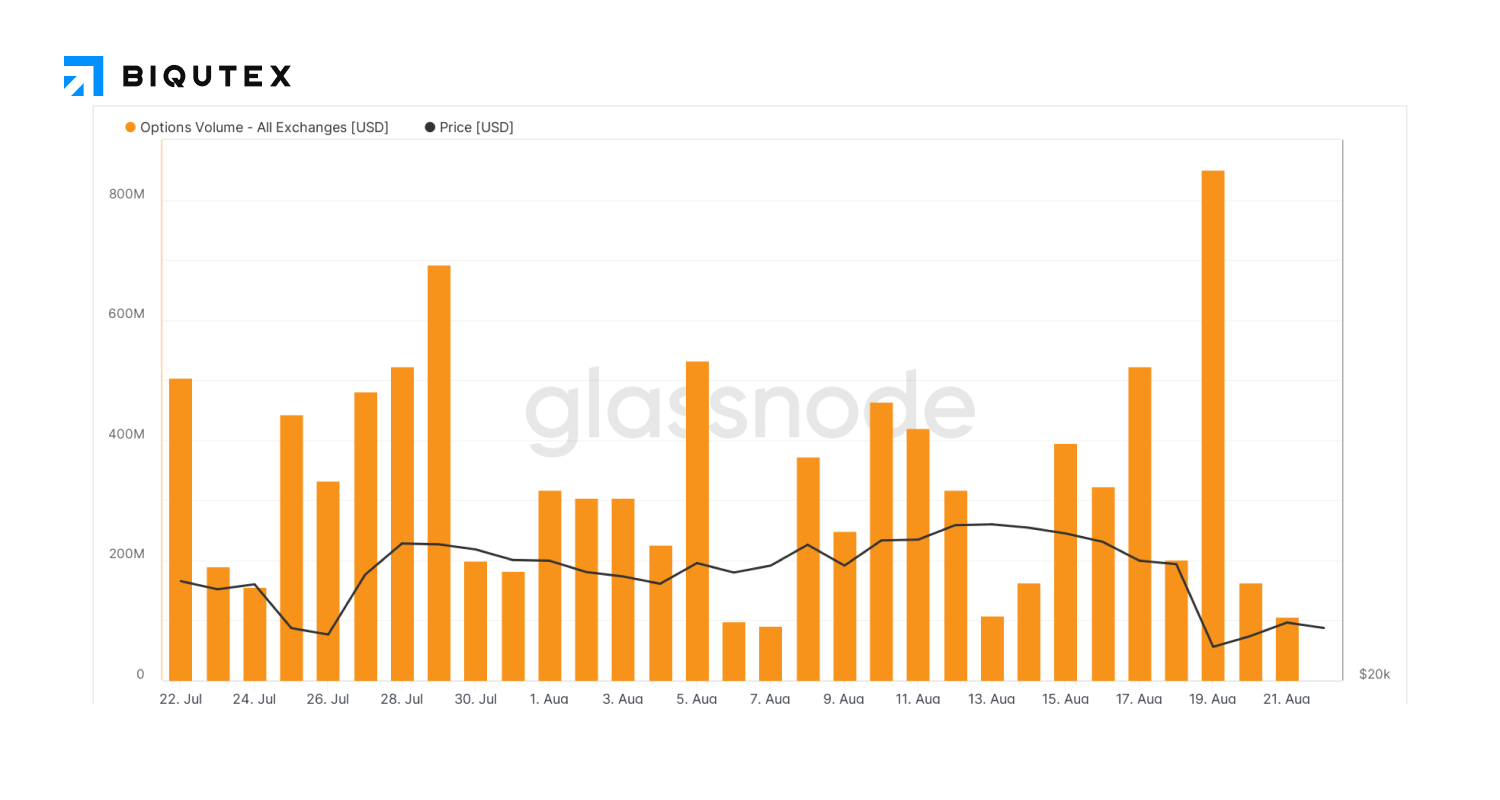

What is notable here is the surge in options trading volume equally for BTC ($800 million) and ETH (also just over $800 million), which coincided with the price decline. Traders probably took the opportunity to build up their Call option positions for December and September and to trade the volatility differential between the underlying assets (selling ETH options and buying BTC options strategy), some of the most popular in the market in the current circumstances.

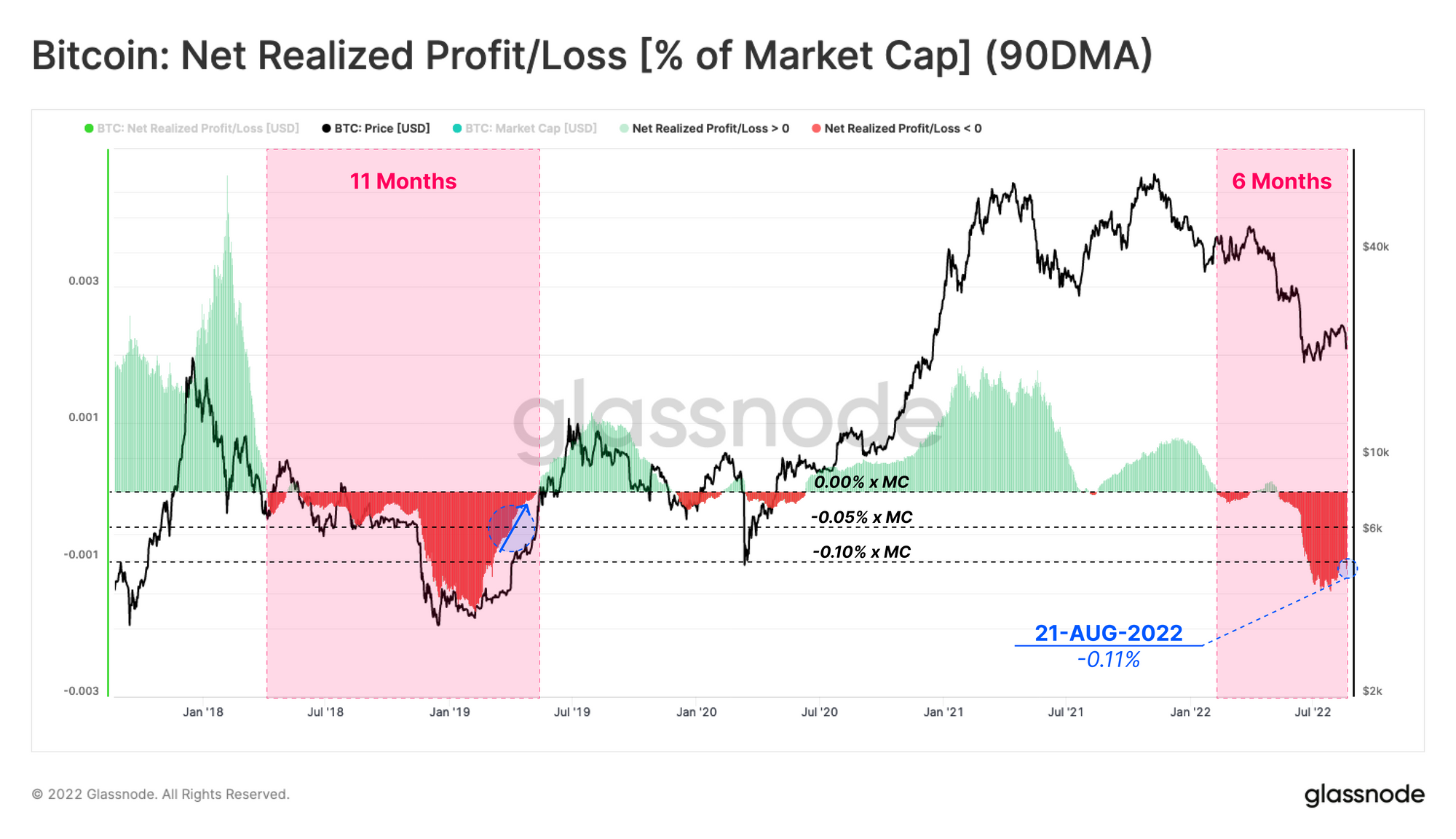

Finding a definitive bottom in the crypto market remains a challenge in the current circumstances. Monetary policy tightening, together with global market uncertainty, is putting a lot of pressure on the price of all crypto assets. Looking at the most studied and established assets, such as bitcoin, and comparing the situation to the past bear market, some indicators show that the price has passed the peak of accumulated losses and is entering a prolonged consolidation phase. It takes time and new liquidity to expect a sustained rise – a period of decline is not the first in the history of the market, and has always ended with the next wave of growth. Whether (and when) the same scenario materialises will largely depend on the stance of government regulators and central banks, which have become much more influential in the crypto economy sector.

This overview was prepared by the analytics department of the Biqutex crypto derivatives exchange