The Derivatives Magazine #8

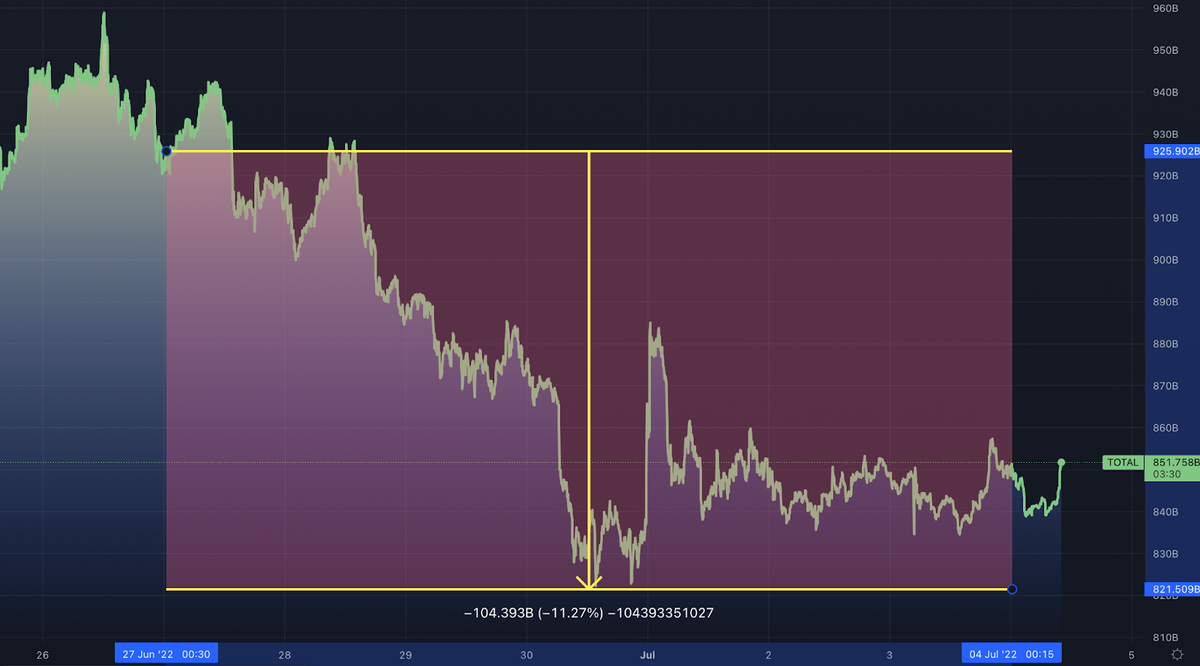

Consolidation in the market continues. After an unsuccessful attempt to get above USD 1 trillion, total capitalisation fell to USD 850 billion and has remained at this level for most of the time. The local weekend in the most capital-intensive US market also contributed to the cooling of stock trading. Last week saw the strategic intentions of US and EU lawmakers to start regulating the cryptocurrency industry by defining how stablecoins should be issued and traded. Greater certainty on this critical issue has also helped to stabilise markets.

Reduced volatility in the markets has led to a decrease in the size of forced liquidations. According to the Coinglass analytical service, bitcoin balancing in the 19 000-20 000 range did not result in more than 150 million closing positions. Such figures are significantly lower than the extremes of mid-June and are moderate for the cryptocurrency market.

The funding rate for margin positions on perpetual swaps is gradually levelling out between the different exchanges. As can be noted from our past reports, the capital flow dynamics stabilise within about two weeks of sharp price movements. At the moment, despite the differences between instruments and venues, the average rate is around 9%, reflecting the market recovery.

Futures are still not experiencing much interest from traders. Open interest is increasing modestly, reflecting a possible seasonal downturn on exchanges – with instruments maturing in September being the most liquid, the market is currently lacking new liquidity and an active desire to create short-term trading strategies.

The volume of open interest in all futures positions remains stable, reflecting a lack of long-term interest in directional price movements. Values around $10 billion USD are average. After last week’s fall, trading volume recovered slightly in the run-up to the weekend, but the dynamic did not develop further.

In contrast to previous periods, last week’s ETH futures trading was almost exactly in line with the BTC market. The volume of open positions stabilised at more than $4 billion, with daily trading volume of around $20 billion. A similar decline in market activity to BTC in the run-up to the weekend just further underlines the overall consolidation of the crypto market.

In the options market, after an epic quarterly expiration, trading volume has declined and is now several times below its mid-June peak. After a huge spike in volatility (the volatility index for BTC and ETH on one of the leading exchanges, Derebit, doubled from standard levels to over 150 and 200 points), activity dropped several times.

At the moment, there is a relative period of stability in the market. The price of the main assets is in a corridor around the lowest annual values. However, the impact of global news has the potential to disrupt this calm. This week expected to be the start of the earnings season for leading US companies, which will provide a significant amount of new information to forecast the future state of the global economy. In addition, the full reports from the Fed’s rate hike committee meeting will be released. While the consensus at the moment is for a 0.75% rate hike at the next meeting in late July, the new economic and corporate data could significantly affect expectations and price values of most volatile assets (including cryptocurrencies). Some regulatory certainty for stablecoins on both sides of the Atlantic could provide significant support for the sector, but external factors continue to weigh much more heavily on the situation and that support may not be enough.

This overview was prepared by the analytics department of the Biqutex crypto derivatives exchange