Ethereum 2.0: Centralization, Censorship and Risks

What is the difference between Proof-of-Stake and Proof-of-Work and who are the validators? Who are validators and how to become an Ethereum validator? Predicted staking returns...

Contents:

- What is the difference between Proof-of-Stake and Proof-of-Work and who are the validators in Ethereum 2.0?

- Who are validators and how to become an Ethereum (ETH) 2.0 validator?

- Possible Ethereum hard forks maintaining PoW mining

- Predicted staking returns

- Censorship in Ethereum 2.0

- Can the government censor/block transactions at the blockchain level?

- Community reaction, development scenarios

What is the difference between Proof-of-Stake and Proof-of-Work and who are the Validators in Ethereum 2.0

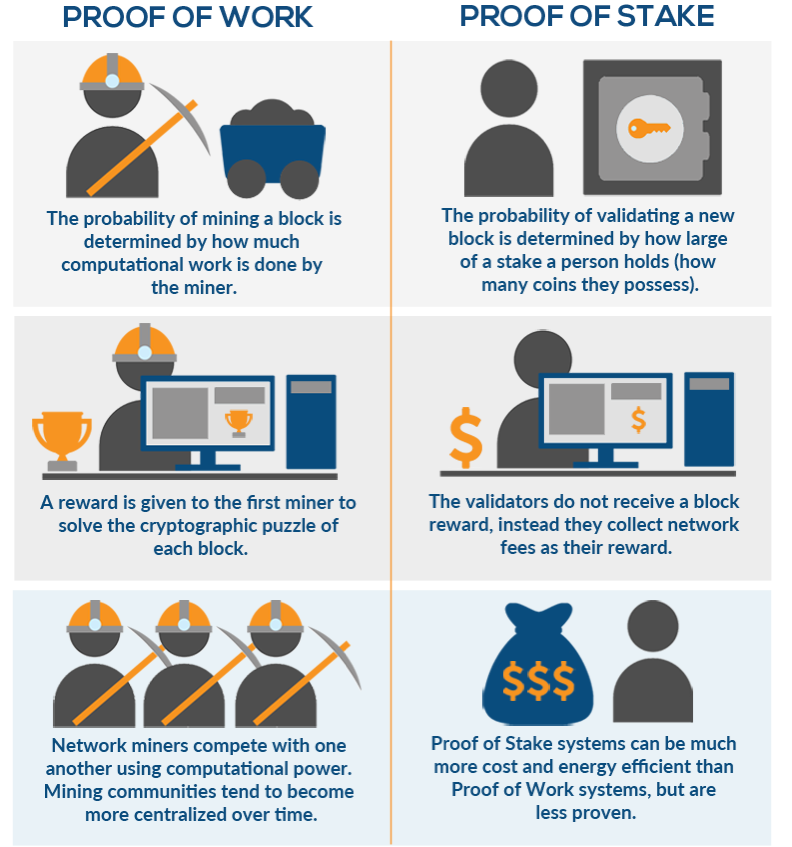

Let us take a brief recourse into history to explore how the two mining mechanisms differ. Under the Proof-of-Work algorithm, the user is required to be constantly online and use their computing equipment to the maximum extent. Only in this case do they stand a chance of receiving a reward for the completed block. The device used for mining, whether it is a GPU, ASIC, FPGA, connects to the project blockchain, accepts and validates all transactions 24/7.

Under the Proof-of-Stake algorithm, the validators are responsible for network security. They are network members who pledge their tokens in a smart contract and verify the generated blocks, earning on the resulting commissions.

Oftentimes, the validators who will be involved in processing blocks are chosen on the basis of a simple concept – the more coins a node was able to stake, the higher the chance that it will be the validator of a new block. However, this will happen only if the node itself functions fault-free. Otherwise, the validator may be subject to penalties, which will be extremely costly. Failures are also possible. Such punitive measures are taken in order to protect the network and make attacks meaningless from a practical point of view.

But a natural question arises – is it worth staking ETH or not? After all, the launch of the new version of Ethereum can take many months and the user will not have access to their funds during that entire period. At the same time, experts expect that users will receive stable profits and argue that it is worth it. It is also possible to state that most of the current stakers are enthusiasts who are more interested in supporting the network at this critical moment in its history, rather than making any money.

How to become a validator in Ethereum 2.0

Users who wish to become validators have two options to participate in staking – Independent Staking and Liquid Staking

To become an independent ETH 2.0 validator, users need to have a minimum of 32 ETH. At the time of writing, this sum is equivalent to about $50,000. Not everyone has such an amount at their disposal. Those who do not meet the minimum threshold have an opportunity to participate in staking and earn through Liquid Staking.

Liquid staking is provision of available ETH to a staking service provider called a pool that can be a cryptocurrency exchange, etc. The developers of Ethereum 2.0 have published a list of such services, but emphasize that none of them have passed any special checks on the part of the developers. Users must independently evaluate the risks and opportunities of each offer.

There are three options for joint staking:

- Staking pools

- Lending platforms

- Exchanges and custodians

Possible hard forks of Ethereum maintaining PoW mining

A hard fork is the division of a cryptocurrency into two chains – the old one and the new one. After the hard fork, one branch works with nodes that support the new rules, and the second branch works with nodes that refuse to support the changes.

After the ETH hard fork, two chains are formed – one is the canonical PoS, and the other is the version mined by the miners – the ETH PoW. The representatives of the network have already said much about the branching of the project. The miners will try to squeeze the last juices out of their soon-to-be-redundant equipment. This is highlighted by the high activity of Chinese pools that do not plan to let go of the profitable mining business.

The miners will certainly keep Ethereum PoW alive. All on-chain assets, such as ETH and other ERC-20 tokens, will be duplicated in the ETH PoW chain, with the difference being that stablecoins like USDC / USDT will be officially worthless and unsecured, since stablecoin issuers will support the main PoS network and will not accept ETH PoW tokens for exchanges for fiat at the rate of 1:1.

For example, a Twitter thread from OlimpioCrypto reviewed the planned Ethereum PoW hard fork and found some opportunities for earning extra Ether

One of the main goals of the Ethereum team is to show how profitable and fast the Proof-of-Stake system is in comparison with the Proof-of-Work approach. The new approach eliminates many of the disadvantages of a PoW system, including electricity costs and the maintenance of expensive equipment.

Predicted staking returns

At the current 14,141,524 ETH available in staking (about 10% of Ether’s market supply), inflation will be at around 2.1%. In other words, the annual volume of new emissions will be approximately 5.4 million ETH.

The following screenshot is a heat map. It shows how changes in the burn rate and staked ETH at the consensus level affect the daily supply of Ethereum.

After the Merge is set into effect and the transition to the PoS consensus takes place, the emission mechanism no longer implies a fixed reward for miners per block. The amount of ETH transferred as rewards to validators will change dynamically, with every epoch lasting 6.4 minutes.

Let us assume that 11 million ETH is involved at the consensus level. The heat map above shows that under such a parameter, 1,511 ETH will be issued per day. After the introduction of the Merge, it will change the mechanism for paying commissions for transactions in the network, since they will not be issued to hardware miners, but to ETH stakers. According to rough estimates, their APY will increase from 4% to 9-12%

Where does such an APY come from? It’s quite simple, really

Hardware miners spend huge amounts on electricity, so they are FORCED to sell the mined coins. With the transition to PoS, the pressure from sellers will drop significantly, because the validator will incur minimal costs, which means there is no need to sell ETH. But many people forget about one more thing – Ether and its rewards cannot be spent until the next fork, which means that users will have to wait 6-12 months after the Merge. As such, we do not recommend believing the rumors that after the Merge 11 million coins will be unlocked – this is a lie. Higher staking returns are an important “driver” of Ethereum demand, with major assets around the world currently showing negative real returns, especially government bonds, fiat money, and others. Ethereum, on the other hand, will offer real returns in double-digit percentages, and investors will not miss this chance.

JPMorgan: Coinbase to be ‘significant beneficiary’ of ETH upgrade due to staking

Coinbase will continue to focus on staking. The goal of the exchange is to become the leading staking provider among cryptocurrency exchange companies. It is also considered that the return on ETH after the Merge in September will be 6.9%. More details can be found here.

JPMorgan: Staking currently rakes in about $9 billion in revenue per year to the crypto industry. Ethereum’s transition to PoS after the launch of the long-awaited Ethereum 2.0 upgrade will drive the adoption of an alternative consensus mechanism and could push industry staking revenue up to $20 billion per quarter and up to $40 billion quarter-on-quarter by 2025.

On the one hand, 6.9% is an excellent yield rate for the US market. On the other hand, ETH is a very volatile asset, and perhaps such a premium will not be enough to interest institutional investors outside the crypto industry.

Centralization and censorship in Ethereum 2.0

At the developers’ meeting, many of Ethereum’s core engineers have spoken out against the transition to transaction censorship.

Lukasz Rozmej mentioned during the meeting that if Ethereum creates the code, which allows for censorship, this would make Ethereum developers “executioners” of censorship in the protocol, a role the developers are unlikely to want to shoulder.

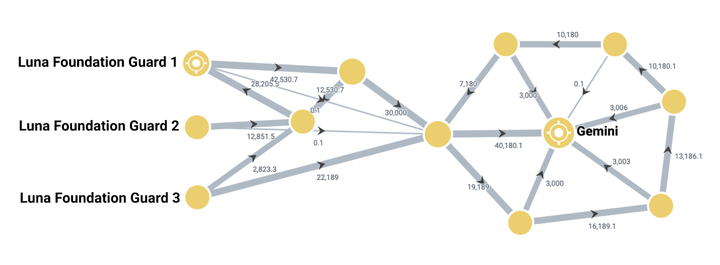

Even Lido – the largest Ethereum staking platform, has a problem with centralization.

Lido receives a certain amount of ETH from users (or validators) who want to participate in Ethereum staking. In exchange, Lido gives them their native ERC-20 coin known as stETH, worth 1:1 to ETH. The platform has its own participation in Ethereum, which consists of ETH collected from the money invested in these validators, which in turn generate rewards. This is how Lido can allow users to invest so little in a blockchain that requires such a high entry threshold.

Lido’s dominance of staking could lead to a centralized attack on the network when it switches to the Proof-of-Stake consensus algorithm, because much of the staking power will be too concentrated, as Danny Ryan, a researcher at the Ethereum Foundation, has warned. Lido also provides more transparency about validators. According to the Lido website, there are 21 validators responsible for staking in Ethereum.

Dancrad Feist, a researcher at the Ethereum Foundation, argued that Ethereum’s developers should be adamant about censorship-resistant qualities. However, no one had a clear plan before the Merge regarding what the developers should do to deal with censorship. If anything became clear at the end of last week’s conversation, it is that this is only the beginning of a long debate.

Can the government censor/block transactions at the blockchain level?

Yes, it is possible! This fact was revealed earlier this month when the US government authorized an Ethereum project called Tornado Cash.

The US government was not a fan of the project from the start and sanctioned it, setting a precedent that if a project does something the US does not like, it can be censored.

“For applications based on the Ethereum blockchain, it is perfectly reasonable and perhaps preferable to block users at risk from Tornado Cash… The alternative would likely result in criminal liability for a large part of the Ethereum network. And that will include the founding teams that are building the nascent decentralized finance (DeFi) alternative economy.” – Daniel Kuhn, CoinDesk.

According to analyst Eilon Aviv, more than 66% of Ethereum 2.0 validators are now ready to comply with US sanctions requirements, if requested. Among them are Coinbase, Kraken, Lido Finance and others.

Vitalik Buterin joined the discussion. Among the options on offer was to “tolerate and comply with the restrictions” or “consider censorship as an attack on Ethereum and burn the share of such validators through voting.” Buterin opted for the second (Forklog).

Vitalik Buterin is also against such censorship, as he is ready to burn the shares of validators if they start blocking transactions at the protocol level.

And how much of the total supply of Ether do we have on centralized exchanges?

At the moment, only 13.8 million ETH, or 11.6% of the total supply, is located on centralized exchanges. BUT most of the 4,653 active Ethereum nodes are in the hands of centralized web providers like Amazon Web Services (AWS), which can “censor Ethereum”.

*Bezos can shut down most DeFi applications if he so desired. Are most Ethereum nodes running on Amazon Web Services?

Recently, one of the largest mining pools – Antpool, refused to support ETH 2.0 mining due to the risk of censorship in different countries, for the security of customers.

Therefore, we cannot say for sure that the government will take full control of the new version of Ethereum. We can only speculate.

Then what are the suggestions to avoid censoring transactions?

Coinbase CEO Brian Armstrong tries to understand the issue in the tweet provided above. Blockchain is trying to adhere to a revolutionary approach, while at the same time maintaining its delicate relationship with the government. We will reiterate the part that Vitalik stated about somehow burning the tokens of the validators who are involved in such practices. Nobody wants to mess things up.

And now let us wind back time to 2017 and understand that not everything is as peachy as it might seem.

Vitalik Buterin apparently considered the transition to PoS a long time ago. In a 2017 tweet, he wrote that regular users should not participate in network governance.

“The idea of average users personally validating the entire history of the system is a weird mountain man fantasy. There, I said it.”

It is funny to see how the Ethereum community is discussing the possibility of activating their own UASF in response to possible censorship attempts by large validators in PoS, being ready to follow US sanctions requirements, similar to Bitcoin’s UASF in the block size war.

The UASF (User Activated Soft Fork) is user-activated software. The activation time is a date that is determined by the full nodes of the decentralized network, not by the miners. At the same time, such blockchain nodes must be an “economic majority”, meaning they must have a decisive influence on the development of a particular cryptocurrency.

Does this mean that the developers of Ethereum decided to trade decentralization in exchange for speed and scaling?

This question can be answered in different ways. On the one hand, decentralization has always been the main vector for the development of Ethereum. But on the other, the pressure of the regulators is forcing Ethereum to lean more towards centralization. The other main risk associated with Ethereum is “blockchain bloat and scalability”. As a global smart contract platform, Ethereum needs to store vast amounts of data, and the network needs to be faster and cheaper to use per transaction than its competitors.

And finally, we are gradually moving towards the reaction of the community. What are users expecting to receive in the end?

Let us explore two scenarios:

Scenario 1 – positive. Here is a direct citation from the head of the analytical department of the ASTL project. “Ethereum has a lot of potential, especially after the transition to PoS, as there will be additional interest in it.” He explained that users will start investing in ETH to create nodes and earn additional income from this endeavor. The expert noted that this will also pave the way for institutional investors, and Ethereum itself will become more environmentally friendly due to the fact that less electricity will be spent on its mining efforts.

The best developers from around the world are working on Ethereum, and the transition to PoS has been in the making for many years. It may seem that growth is guaranteed after the Merge and things are rosy. But it all seems suspiciously simple. Especially for the crypto industry. Let us think about the second scenario.

Scenario 2 – negative.

Market sentiment. The balances of the top 10 ETH wallets have started to plummet, and the balances of the top 10 exchange wallets have risen sharply in contrast. Why so, might you ask? We will tell you. As a rule, there is a powerful influx of an asset to exchanges right before the collapse of the price of said asset. The transfer of an asset to the exchange signals the intention of its holder to start selling. It seems we really are moving towards Scenario 2.

As we know, the CME group added Ethereum options to its listing just before the Merge update. There is a possibility that these Ethereum options have appeared for a reason, as large players may open positions on Put options, betting on the collapse of the price of ETH after the update.

This will allow large options players to get more profits. But what if Ethereum starts losing not only in price, but also in the reliability of the network as a whole due to the huge number of errors in protocols and DEX applications, and DeFi landings that are built on Ethereum? Such applications can lose in terms of security, be subjected to hacker attacks, and gain new vulnerabilities that can be exploited by malevolent players to steal funds not only by means of hacks, but also thanks to the prevalent market situation. Therefore, it is quite possible to consider Ethereum 2.0 as a black swan, which will inevitably pull the entire crypto market with it.

In conclusion

Coinshares: a “buy the rumors, sell the facts” situation may be in place for Ethereum.

Mark Cuban: a “buy the rumors, sell the facts” situation may be likely in the case of Ethereum’s upgrade.

Glassnode: ETH derivatives markets are giving conflicting signals ahead of the September update. Some traders are betting on a bullish outcome with put options. But the fluctuations of futures and options charts are indicating that a backwardation is possible in September, which implies that the market is betting on the “buy the rumors, sell the facts” scenario.

This research was prepared by the analytics department of the Biqutex crypto derivatives exchange