Special Research: FTX Game Over

Interlude

2022 was a difficult and challenging year, not only for crypto-enthusiasts, but also for the global economy as a whole. Post-pandemic problems with logistics, inflation, and the balance of payments of developed countries were greatly complicated by military conflicts in Europe, political uncertainty in the US and China, and constant tension around Taiwan.

The cycle of rising rates in the U.S. debt market, which began in the spring, led to reduced liquidity in the cryptocurrency ecosystem and lower prices for risky assets. The situation was exacerbated by the collapse of the LUNA blockchain and the wiping of 40 billion in capitalization from the market within one week. The subsequent bankruptcies of major crypto brokers 3 Arrows Capital and CeFi liquidity aggregators Celsius/Voyager seemed to be the peak of trouble in the market. However, in the fall, investors and traders faced a “black swan” of a much larger scale – the bankruptcy of one of the largest crypto exchanges, a top-3 venture capital fund, and over 5m ruined clients.

Introduction

Nothing foretold trouble when on November 2 the news portal Coindesk published a news item devoted to the balance sheet of the Alameda Research venture capital fund and also affecting the FTX exchange. The report concerned assets as of the end of the 2nd quarter 2022. FTX tokens accounted for more than 40% of its 14.9 billion in assets, with the fund's liabilities in other cryptocurrencies (like stablecoins, Bitcoin or Ether) given the limited liquidity of the token, the assets were clearly not enough to cover it.

The publication triggered a lot of concerned comments from market participants on social media. Subsequently, Twitter became the main arena for the exchange of information, opinions and rumors. On November 6, the head of the rival exchange Binance posted there an official statement about the intention to sell all FTT tokens that were on the company's balance sheet at the market price. The justification for this decision cited doubts about the capital adequacy of FTX and Alameda. Alameda Reserch's reply offer to redeem the tokens at a price of $22 as part of the OTC transaction was not accepted, which led to the outbreak of panic and mass withdrawal requests from FTX users.

As further events showed, their worries were not in vain. Only four days passed and the withdrawal was halted. Before that, Sam Bankman-Fried, the head of FTX, had approached Changpeng Zhao, the head of Binance, with an offer to buy his exchange or enter the capital. However, as a quick check of the exchange's fortunes showed, even Binance did not have the financial capacity to close the capital hole.

As a result, the exchange filed for bankruptcy and capital protection from creditors in the U.S. District Court for the Southern District of New York on November 11.

State of the FTX balances

In general, if you look at the asset dynamics within the on-chain analysis (according to Glassnode), FTX hot wallets have rarely held more than a few billion USD.

Comparing balances of the market leader - Binance exchange and the third largest by turnover and capital size (till November) exchange FTX, you can see how the dynamics of funds movement differs from time to time. The fall of the crypto market in May and June had almost no effect on Binance, while for FTX it was important, which led to irreparable reduction of reserves. Whereas at the peak of April-May FTX had 139 000 BTC and 850 000 Ether (for comparison at Binance these figures were equal to amounts of 562 000 and 4 300 000 respectively), already in July the values were at 60 000 BTC and 560 000 for Ether (at Binance - 625 000 and 4 000 000 accordingly). And after a small influx on Ether, the balances continued to fall until they almost completely melted at the beginning of November.

So how is it that one of the industry's flagships collapsed completely and unexpectedly to the external observer?

Details from the court sessions.

Most of the information at first came to the community from the publications of the business press - Reuters, Bloomberg, Coindesk and WallStreetJournal. In general, all major publications focused on the coverage of this topic. However, most of the publications did not name the sources and the information was difficult to verify. Thus, details surfaced about the purchase of expensive real estate in the Bahamas, where the FTX headquarters is registered, for FTT tokens and cryptocurrency from the balance sheets of the exchange to the personal accounts of employees. There was also information about vulnerabilities in the exchange engine and the use of customer funds and internal accounts of the exchange in violation of regulations and without following control procedures. After the bankruptcy filing, more verified information began to emerge, and most of the rumors were indeed confirmed.

And, here's how it was.

As part of the bankruptcy proceedings, the new CEO John Ray III, known for his involvement in numerous similar proceedings in the U.S., reported many interesting details under oath.

FTX's total preliminary balance sheet currently consists of 8.9 billion in liabilities to customers and creditors and about 11 billion in assets, only 900 million of which are in liquid form. The rest of the funds are in the form of poorly liquid tokens from various crypto projects (including the FTT token, the exchange's internal token, with which the entire sale was announced). The exact amount of funds by asset and liability has yet to be clarified - FTX as a global company consisted of many companies across multiple jurisdictions. At least 134 companies appear in the bankruptcy filing.

How did it happen that instead of assets in the liquid form of BTC, Ether or Stablecoins, there were so many unsecured and objectively garbage tokens on the balance sheet? The fact is that Alameda Research Venture Company and FTX Exchange had one controlling owner, the head of the exchange, Sam Bankman-Fried. So when Alameda ran into liquidity problems in the summer of 2022, more than $4 billion in liquid assets were transferred from the exchange's balance sheet as collateral for the FTT tokens. These funds did not belong to the exchange itself, but to its creditors and customers.

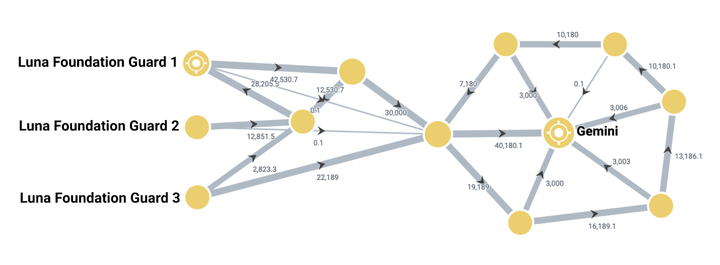

This was not an isolated incident. As Nansen.ai's research showed, the FTT token was regularly used by Alameda to take virtually unsecured loans from the exchange in liquid assets in the form of BTC, Ether, and stablеcoins. By controlling token supply and market liquidity, FTX and Alameda manipulated the price to increase the value of the FTT token and used it to borrow. And while Alameda borrowed from FTX, the exchange itself borrowed funds from other companies, such as Celsius and Genesis (the trading arm of DCG, an industry leader that, among others, owns bitcoin's largest corporate owner, the Grayscale Trust).

Biqutex Exchange

Biqutex is an innovative crypto derivatives exchange. Trade an extended list of instruments (Perpetuals Swaps, Futures, Options, Calendar Spreads etc.) with up to 125x leverage and deep liquidity!

Consequences

At the moment, it is difficult to make a final conclusion about the size of losses and the future of the FTX exchange. The hole in the balance sheet, the deception of investors and customers is the subject of future litigation.

However, it is already possible to summarize the intermediate results:

- What began as a hostile takeover and merger attempt – when Binance publicly opposed FTX – went far beyond the boundaries of the two companies;

- A lot of big traders lost their funds, including global crypto market makers;

- The FTX investment of $1.8 billion that the company has raised in recent years has been written off as "0" by most investors;

- The crypto industry has tried to add more transparency to centralized exchanges by conducting a series of publications of its reserves and wallets with the help of Binance;

- However, without commitment, this information remains less useful, and encourages users to use DeFi applications - lending, exchanging, trading, and issuing stablecoins;

- The BNB Chain ecosystem was the first to feel the impact in the form of user and liquidity inflows. Another beneficiary was the Ethereum ecosystem, in particular the Uniswap decentralized exchange and dydx and GMX derivatives trading platforms;

- The Solana ecosystem, in which both Alameda and FTX actively invested, became the main victim - the volume of liquidity has now fallen to 200 million, dropping from the highs of a month ago by 7 times. The future prospects for blockchain (and the SOL token) are murky.

- The outflow of stablecoins from the crypto segment is relatively small - about 2% (3 billion USD), indicating that the negative effect on the entire market is limited;

- The amount of liquidity in trading decreased by about 30% in the first days after the FTX collapse in the spot and futures market, and has stabilized at the moment.

A separate question is what fate awaits the projects in the Alameda Research and FTX Ventures portfolios. Some tokens from investments are in a blocked state, and the blocking time reaches several years. That said, we should keep in mind that some projects where there are company investments have been built into the work of the MTF exchange, such as the token of the decentralized CLOB aggregator Serum (SRM). Without the exchange, much of the functionality of the product, in which other companies have invested, is lost. How co-investors, Alameda and FTX Ventures will behave with tokens from such projects is an open question.

The collapse of the exchange was a strong reason for regulators in all countries to pay more attention to the regulation of cryptocurrency exchanges and the creation of legislation to protect the rights of investors and traders. Such loud and epochal collapses of crypto companies have happened before, but the cryptocurrency industry has always recovered and continued its development. We assume that also this time the negativity will be surmounted and forgotten after some time.

This research was prepared by the analytics department of the Biqutex, an innovative crypto derivatives exchange. Trade an extended list of instruments (Perpetuals Swaps, Futures, Options, Calendar Spreads etc.) with up to 125x leverage and deep liquidity!