What scalping is: how it works and what newcomers should do

Crypto scalper in trading are traders who buy and sell cryptocurrencies within a very short period of time, typically seconds to minutes, with the goal of making small profits on every trade. Scalping crypto works by taking advantage of price fluctuations in the market caused by volatility and supply-demand dynamics. The scalper will monitor the market for these fluctuations and quickly execute trades to profit from the price difference. Scalping in cryptocurrency can be very profitable but also carries a higher level of risk, as the scalper is making a large number of trades in a short period of time.

Best time frame for scalping crypto

Crypto scalper typically look for high volatility and tight spreads, which are often present during high-volume trading periods such as the opening and closing of major stock exchanges. For example, the time between 9:30 AM to 11:30 AM and 2 PM to 4 PM Eastern Standard Time (EST) on weekdays is often the most active for Bitcoin trading. Scalping meaning crypto is the same as stock scalping.

The more traders currently trading and the higher the trading volume, the better it is for scalping in cryptocurrency.

Three of the best crypto scalping strategies

The strategies are related to the instruments you are trading.

Range trading

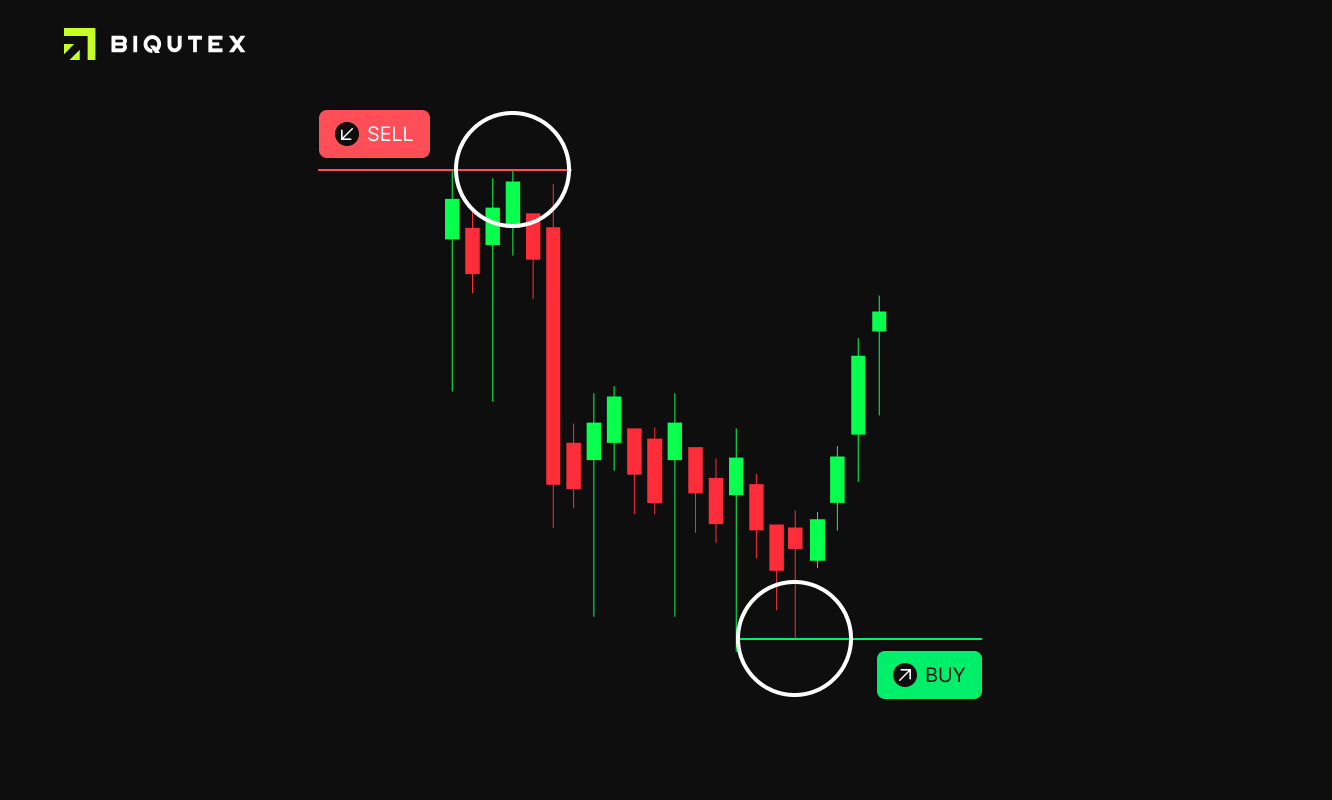

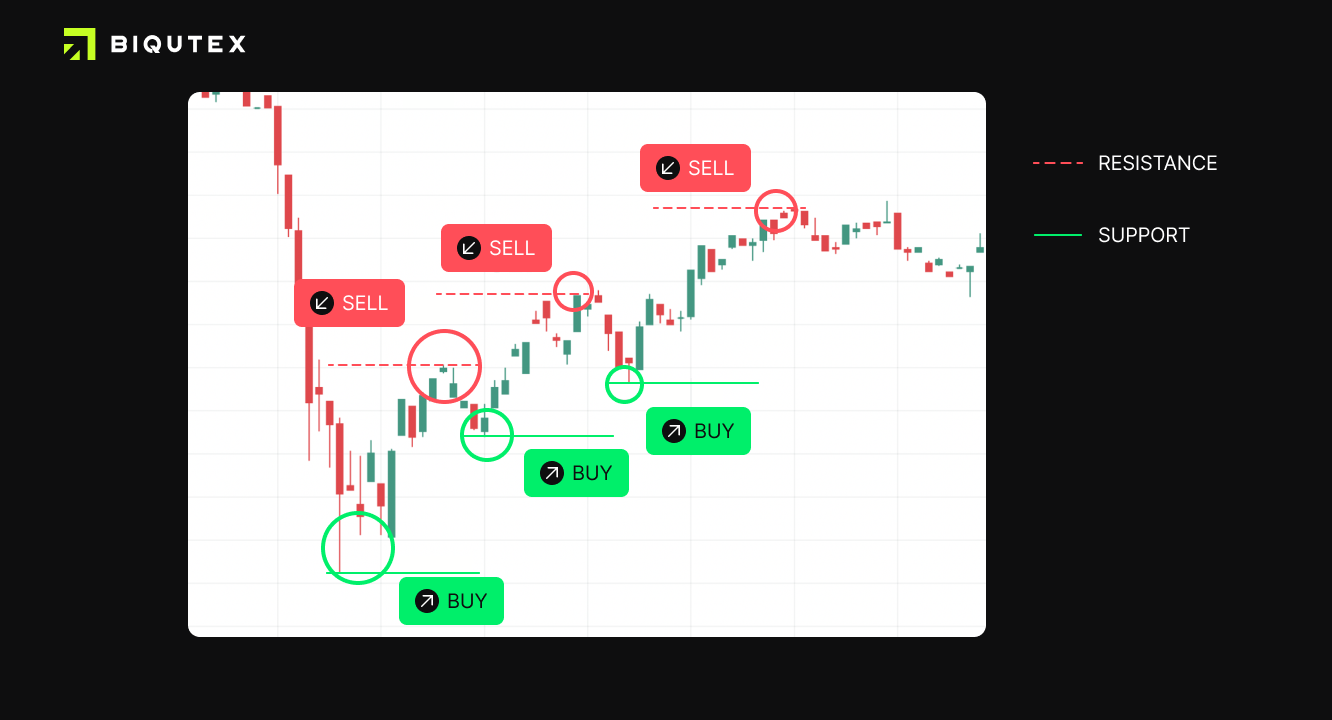

Range trading is a technique used by many traders to identify the upper and lower boundaries of a price range. This range is typically defined by support and resistance levels, which are the prices where buyers and sellers are most likely to enter or exit the market. By identifying these levels, traders can anticipate price movements and make trades based on the direction of the trend.

The first step in range trading is to identify the support and resistance levels. This can be done using technical analysis tools, such as trend lines, moving averages, and oscillators. These tools can help traders identify key levels where prices are likely to rebound or break through.

Once the support and resistance levels are identified, traders can start looking for trading opportunities within the range. This can be done by buying at the support level and selling at the resistance level.

Traders can also use other indicators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) to confirm the trend and make more informed trading decisions. We will write about these indicators below.

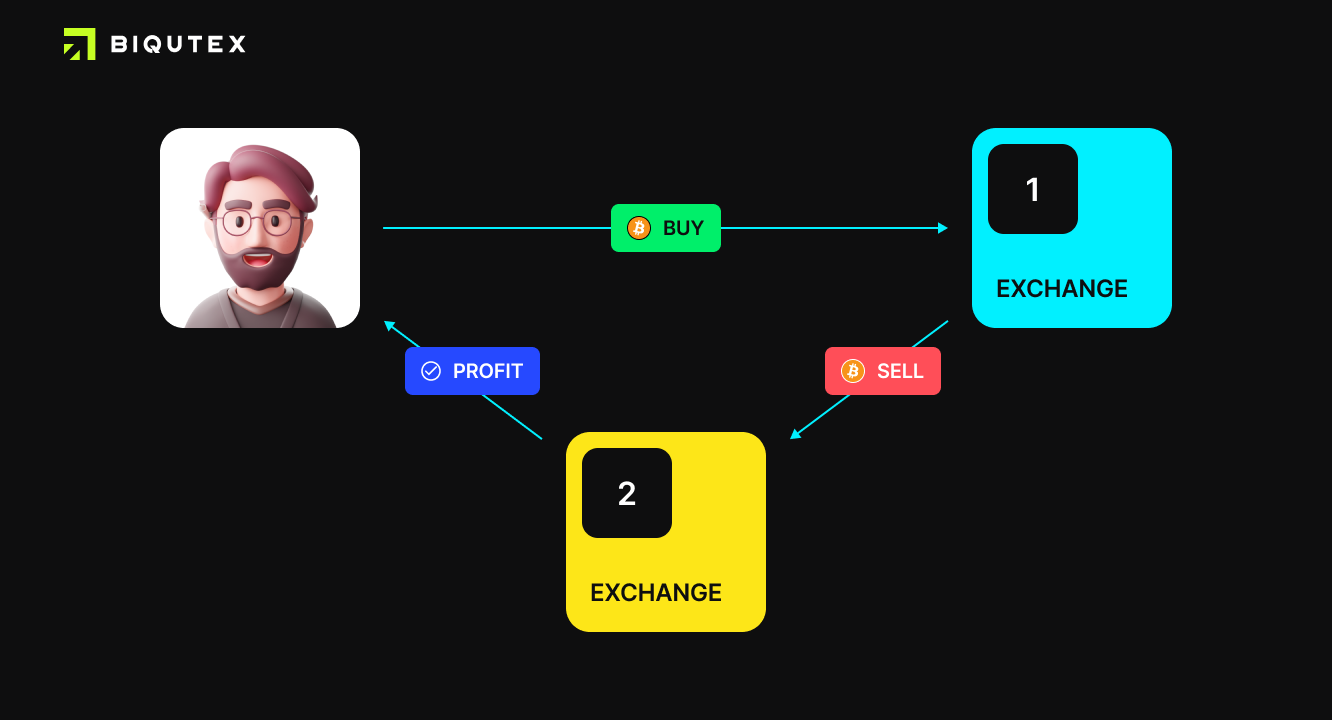

Arbitrage Strategy

The easiest to understand, but not the easiest to implement. It often happens that prices on different exchanges differ for the same assets. This means that with proper preparation and speed you can manage to buy cryptocurrency on one exchange and sell it on another. It is very important to take into account slippage, exchange fees and the time you will spend on this transaction. Chances are you may not make it in time, so calculate your risks!

This view is engaged mainly with the help of special software. It automatically tracks asset prices and can make transactions. We, of course, do not recommend and do not guarantee you earnings, but you can explore the topic in more detail and find the necessary software.

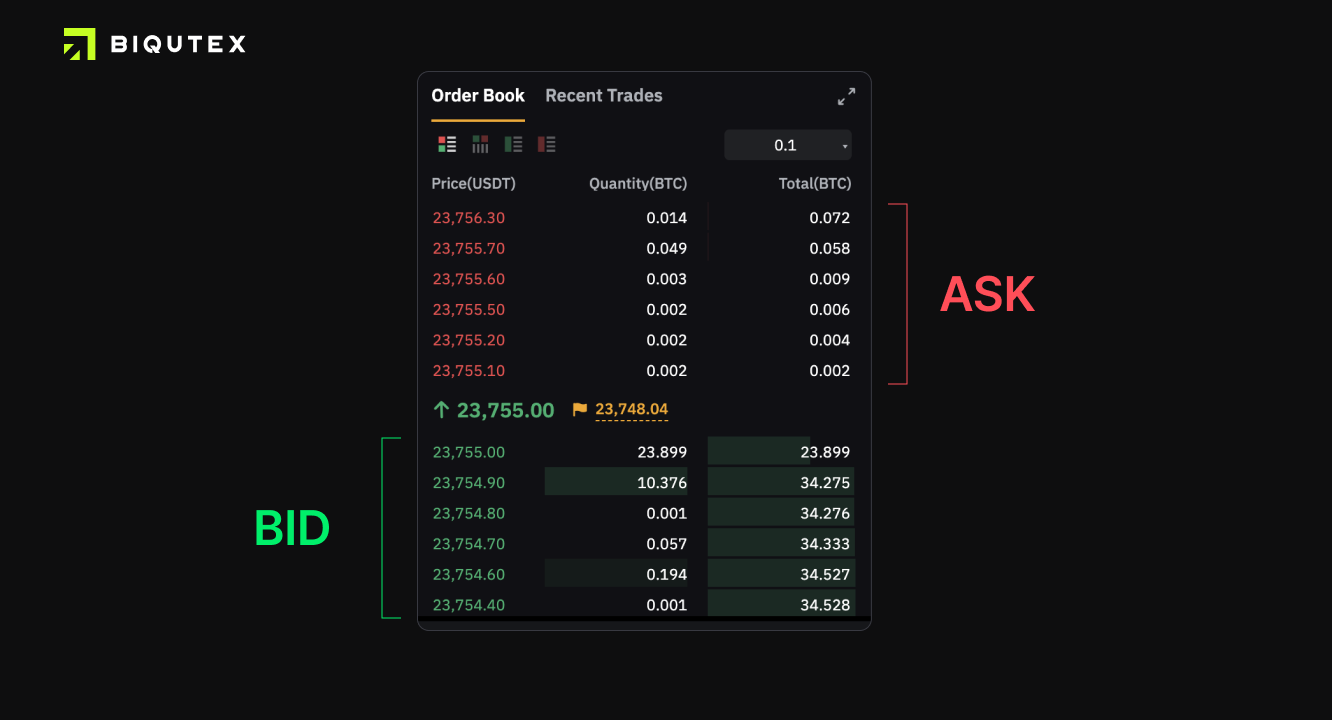

Bid-Ask Spread

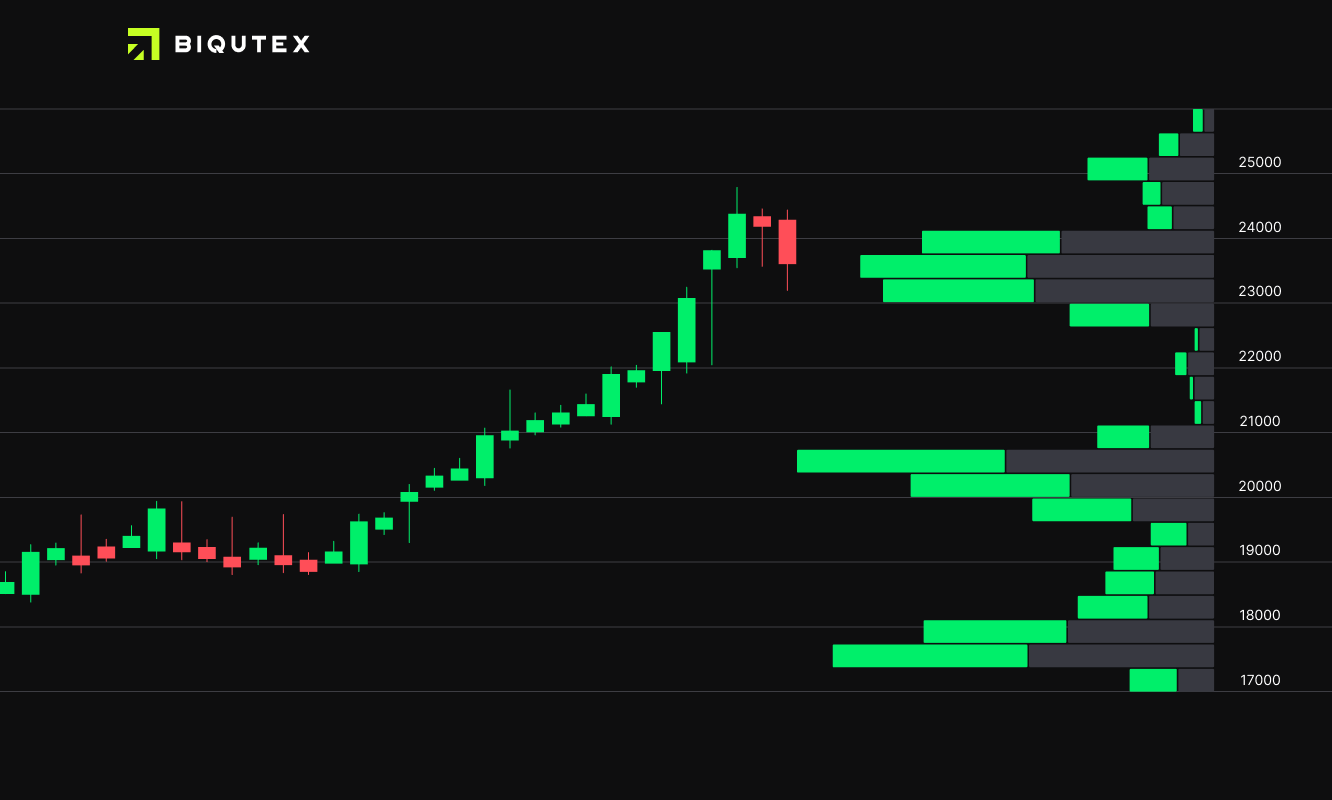

The book order reflects the number of Ask and Bid orders. It also reflects the mood of traders at that moment when you look at it. Sometimes there is an imbalance in the order book: there can be many times more sell orders than buy orders.

Traders use this as one of the indicators for deciding whether to enter or exit a trade. For example: the illustration shows that the demand to sell exceeds the demand to buy. The number of Bids is much greater than the number of Ask, which could mean that the value of the asset may go down.

Best indicator for scalping

Scalping trading strategies mostly use these instruments:

- Moving Average

This strategy involves using moving averages to determine the direction of the trend, and then entering and exiting trades based on the price action near these moving averages. - Bollinger Band

This strategy uses Bollinger Bands to identify overbought or oversold conditions and enter trades based on these conditions. - Trendlines

This strategy involves drawing trendlines on the chart and entering trades when price breaks through the trendline. - Breakout

This strategy involves identifying key levels of support and resistance and entering trades when price breaks through these levels. - Momentum

This strategy involves using momentum indicators to identify trend strength and entering trades in the direction of the trend.

These were the best scalping strategy crypto. But strategies are defined not only by the tools but also by the applicable rules:

- Payoff-ratio

We always recommend a profit to risk ratio of at least 3 to 1, but experienced traders trade at a 1:1 risk. It's just that why take the risk at a 1:1 ratio? - Hit rate-ratio of profitable trades to losing trades.

Experienced traders have it as high as 50-60%. If you are a beginner, 10-20% is fine. - Basic rules

Do not trade with the whole deposit, do not use a leverage of more than x3 if you are a beginner, take your time.

The main thing to remember is that we pay for everything: time, effort, money, health. In trading we pay money for knowledge: before you become a professional trader you will make mistakes hundreds of times.

Best crypto coin for scalping

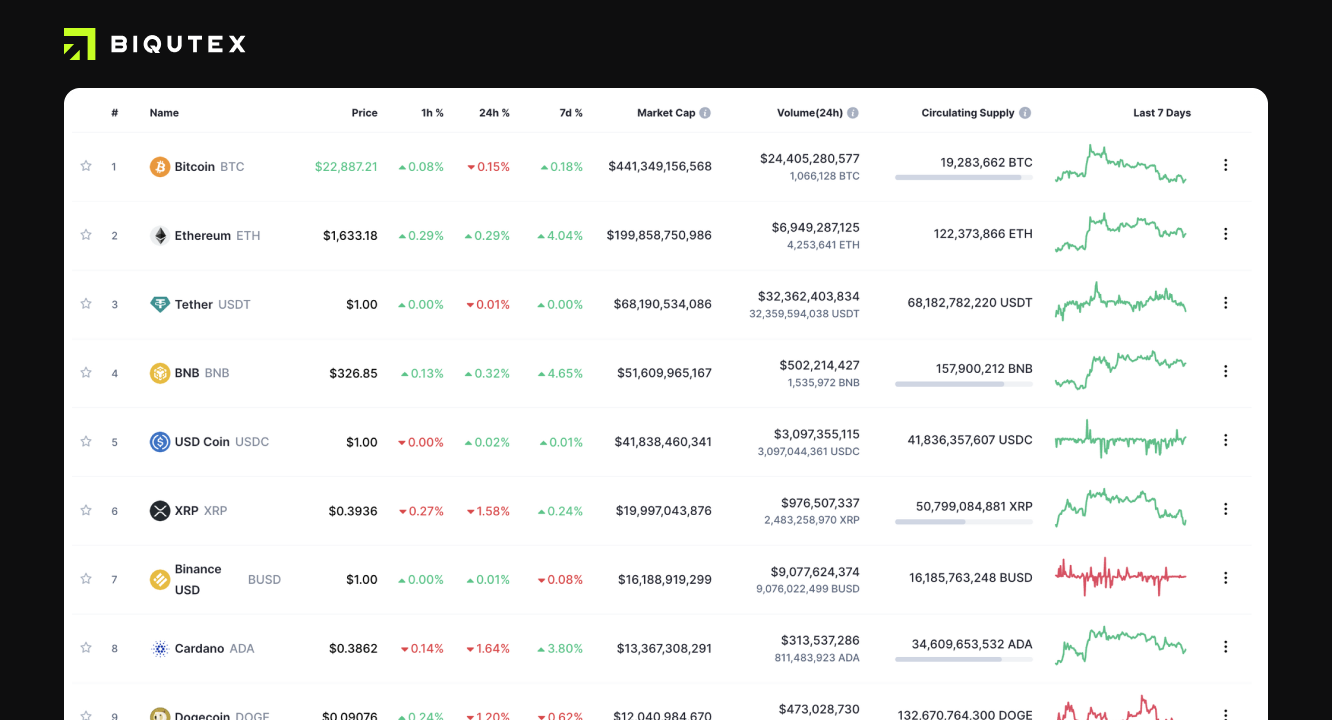

If you're reading this, you obviously haven't yet become a professional trader. Then there's another rule for you: "don't trade coins that are not in the top 10". You can check the top coins on Coinmarketcap.

The best crypto to scalp is the one that works 'by the rules'. These are the established coins that bring no surprises. They are quite difficult to collapse or have a big impact on their value.

Unknown coins are often subject to pumppings and dumps, scams and too unpredictable a price movement. That said, the standard rules of technical analysis and any others may not work for them.

Biqutex Exchange

Biqutex is an innovative crypto derivatives exchange. Trade an extended list of instruments (Perpetuals Swaps, Futures, Options, Calendar Spreads etc.) with up to 125x leverage and deep liquidity!